by Ben Jennings, Lead Advisor, CFP®

Last month, we began a series we could call “The People in Your (Estate) Plan.” We started with the people designated for roles that protect your kids. This time, I’d like to think about the people protecting your stuff (that’s a fancy legal term!).

Who are we talking about?

These roles commonly fall into two broad categories under three titles.

First, you will name a person to act in your stead after you pass away to pay your financial obligations and eventually distribute your resources to the folks you want to have those assets. We used to refer to this person as your executor, but the modern term is Personal Representative.

Second, you may need to name someone to manage your financial affairs while you are still alive. This is your Agent under your durable power of attorney (DPOA). It’s like the old driver education car that comes with an extra set of controls. You can still handle those tasks you’re up for, but we add an additional person who can assist as needed. (Note: if you lose the capacity to manage your affairs prudently, a court can name a similar person, termed a guardian or conservator, to make decisions for you. In this situation, however, they take over responsibility for your decision-making rather than sharing the duties with you.)

The third common title is Trustee. Depending on the situation and the approach in your estate plan, your trustee may act on your behalf before and/or after your passing - so they sort of fall into both of the categories above.

What to Look For

All of these roles involve fiduciary responsibility. This means the person in the role has a legal obligation to put your best interests first in their decisions and actions. So, you obviously want someone who is trustworthy and of good character; integrity is a must. What else should you look for when naming someone to fulfill these roles for you?

Top of the list in my mind is a proven ability to be organized and pay attention to detail.

Next, these folks are going to make decisions that will impact your family and other heirs. It’s helpful for them to be able to explain their choices calmly and logically, ideally in a way that will avoid ruffling feathers or feelings. Diplomacy, patience, and effective communication are needed!

Further, your fiduciaries need to have adequate capacity to take on a set of tasks that not only consume significant time but also go on for months at an absolute minimum, and more likely for several years.

What Else to Know?

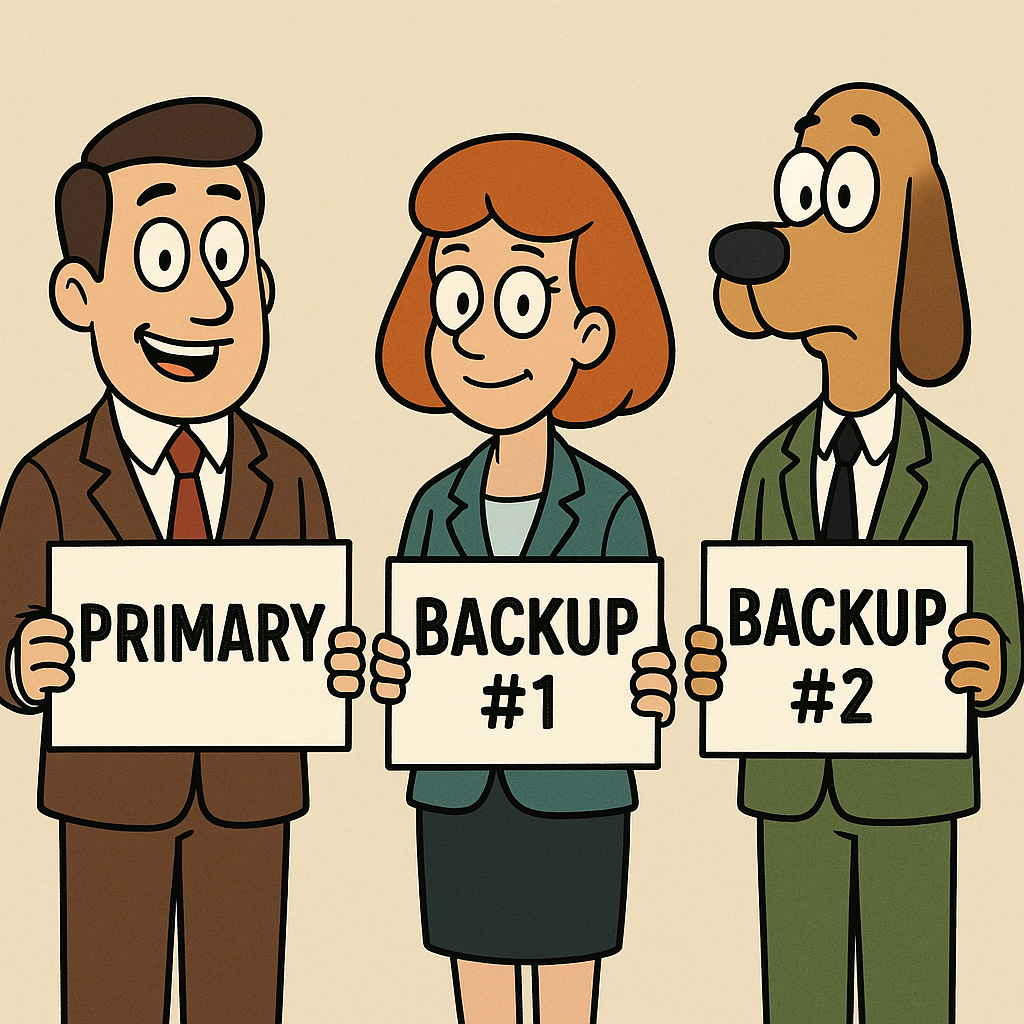

You need more than one. We suggest that for every role in your estate plan, you name a primary person and two back-ups.

On the other hand, you need only one at a time. Clients sometimes want to have people “share” roles. Our experience suggests that this is a recipe for strife during an emotionally charged time.

These are not small jobs. Even if the person is a beneficiary of your estate, we suggest allowing for reasonable compensation for the time these duties will require.

The time to learn you’re being selected for a role like this is not when it’s time to get to work in the role. Have communication in advance with the people you want to select as your fiduciaries!

It can be a tall order to choose the right people for this. It is, however, worth the attention and consideration it deserves. If you would like to discuss this with us during our meeting this fall, we welcome the conversation!